20+ mortgage year terms

Web Most fixed-rate mortgages are for 15 20 or 30-year terms. 2022s Top Mortgage Lenders.

:max_bytes(150000):strip_icc()/dotdash_INV_final-The-Risks-of-Mortgage-Backed-Securities-Mar_2021-01-d9076937fc9944049f46c85c78098e39.jpg)

The Risks Of Mortgage Backed Securities

A 30-year fixed-rate mortgage is by far the most popular for a simple reason.

. Web You can choose a 10 15 20 25 or 30year term for fixed-rate mortgages. Web If you need lower monthly payments a 30-year mortgage may be the better move. Compare Offers Side by Side with LendingTree.

Veterans Use This Powerful VA Loan Benefit for Your Next Home. Keep in mind your monthly mortgage payment may also include property taxes and home insurance - which arent included in this amortization schedule since the payments may fluctuate throughout your loan term. Web A mortgage loan term is the maximum length of time you have to repay the loan.

An adjustable-rate mortgage ARM offers a lower rate for a set number of years at the start of the loan. Web A 20-year mortgage offers borrowers the chance to pay off their loan faster than the popular 30-year term. Web Mortgage Rates for March 3 2023 This chart displays offers for paying partners which may impact the order in which they appear.

Get Instantly Matched With Your Ideal Mortgage Lender. The 1 represents how often your interest rate will adjust after the initial five-year period ends. 20-year mortgages tend to be priced at roughly 025 to 05 lower than 30-year mortgages.

What are the benefits of a 20-year fixed mortgage. Compare Your Best Mortgage Loans View Rates. Comparisons Trusted by 55000000.

Web The amortization period is the length of time it takes to pay off a mortgage in full. Common mortgage terms are 30-year or 15-year. Low down payment options and competitive rates are just some of the advantages of SoFi Home.

Get Instantly Matched With Your Ideal Mortgage Lender. Web Instead of a 30-year mortgage at 325 you opt for the 20-year term at 3 you can save around 4931350 in interest throughout the lifetime of the loan. The average 20-year refinance APR is 714 according to Bankrates latest survey of the nations.

Ad Compare Loans Calculate Payments - All Online. See how those payments break. Web The following table lists historical average annual mortgage rates for conforming 30-year mortgages.

But homeowners who can manage a larger monthly payment will find greater interest savings with 15-year rates. It has an interest rate that does not change throughout the life of the loan. A shorter period such as 15 or 20 years typically includes a lower interest rate.

Ad 20 Year Mortgage Rates Compared. Web Mortgage rates shot up for the fourth consecutive week as inflation concerns remain. Loan term years.

If your down payment is less than 20 of the price of your home the longest amortization youre. If you put down less than 20. 20 Down Payment Home buyers who.

Comparisons Trusted by 55000000. Ad Calculate Your Payment with 0 Down. Ad 10 Best House Loan Lenders Compared Reviewed.

It has a 5 year term an amortization period of 20 years and an interest rate of 6. Lock Your Rate Today. Lock Your Rate Today.

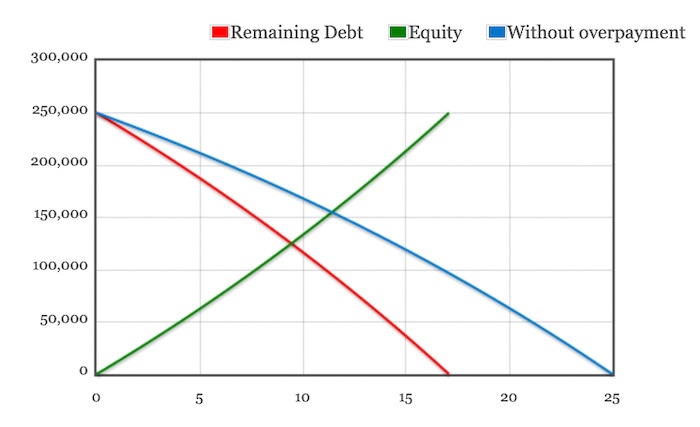

Web 10 year term 20 year amortization - The mortgage amortization schedule shows how much in principal and interest is paid over time. Web The 20-year mortgage is a solid middle ground between the popular 30-year and 15-year mortgages. Ad 20 Year Mortgage Rates Compared.

Shorter terms help pay off loans quickly saving on interest. Is a 20-year fixed mortgage right for you. It was 301 one year ago.

Web See how your payments change over time for your 30-year fixed loan term. Web The rate for a 15-year mortgage popular with those refinancing their homes rose this week to 589 from 576 last week. Web Use Bank of Americas comprehensive mortgage terms glossary to get definitions of mortgage terms that may come up throughout the loan process.

Web At 6 homeowners looking to refinance into a longer repayment term may want to consider 20-year rates. 30 year fixed. Web A 20-year fixed-rate mortgage is a balanced-term loan that few people think to consider.

Ad 10 Best House Loan Lenders Compared Reviewed. Refinance in 23917 300000 Home Value with a 240000 Loan Balance. Check How Much Home Loan You Can Afford.

And while a 15- or 10-year mortgage could save you even. Web Most fixed-rate mortgages will have a 30-year or 15-year term though some lenders offer 20-year terms and some even allow borrowers to choose their own term. Home buyers should consider all possible home loan options before committing to a.

For most types of homes. 2022s Top Mortgage Lenders. Web On Saturday March 04 2023 the national average 20-year fixed mortgage APR is 693.

The introductory rate is fixed and often lower than competing fixed-rate mortgages. At 575 a 15-year term. A 20-year mortgage has.

While they provide a fixed principal and interest payment youre not stretching out the payments. It is the interest rate expressed as a periodic rate multiplied by the number of compounding periods in a year. Longer terms usually have higher rates but lower monthly payments.

740-850 Credit Score Change Search. In a home equity line of credit for example the repayment period typically 20 years is the loan term that follows. And then theres property taxes and homeowners insurance.

Web The most common mortgage terms are 15 years and 30 years although 10- 20- and 40-year mortgages also exist. Mortgages are further divided into fixed-rate and adjustable-rate mortgages. The amortization is an estimate based on the interest rate for your current term.

Ad Compare the Best Mortgage Rates From Top Ranked Lenders Apply Easily Online. SoFi offers fixed-rate mortgages with terms of 10 15 20 and 30 years. If youre refinancing this number will be the outstanding balance on your mortgage.

Web A 20-year fixed-rate mortgage is a home loan that has a repayment period of 20 years. Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years. They also charge less interest.

Ad Top Home Loans. Ad Get the Right Housing Loan for Your Needs. Web A 51 adjustable rate mortgage ARM or 5-year ARM is a mortgage loan where 5 is the number of years your initial interest rate will stay fixed.

The 30-year fixed-rate mortgage averaged 665 in the week ending March 2 up from 65 the week before. Web You can view amortization by month or year.

The Curve Of Relationship Between Market Value Of Mortgage And Interest Download Scientific Diagram

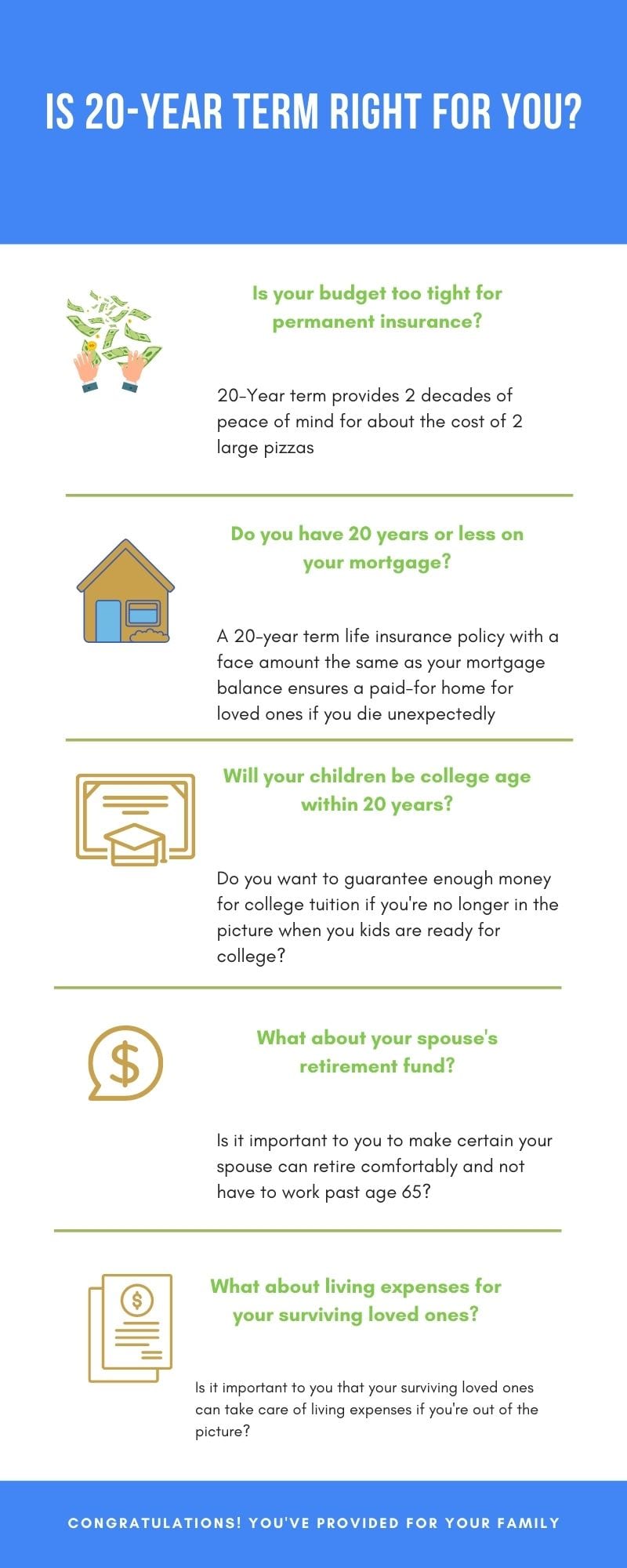

20 Year Term Life Insurance Lifeinsure Com

:max_bytes(150000):strip_icc()/Syndicated_Loan_Final-05a554cb88bb439cab1ccc32751b437f.png)

Syndicated Loan What It Is How It Works Examples

Use These Tips To Pay Off Your Mortgage Early

:max_bytes(150000):strip_icc()/shutterstock_104419181.mortgage.rates.cropped-5bfc3136c9e77c00519bb1ee.jpg)

How Mortgage Interest Is Calculated

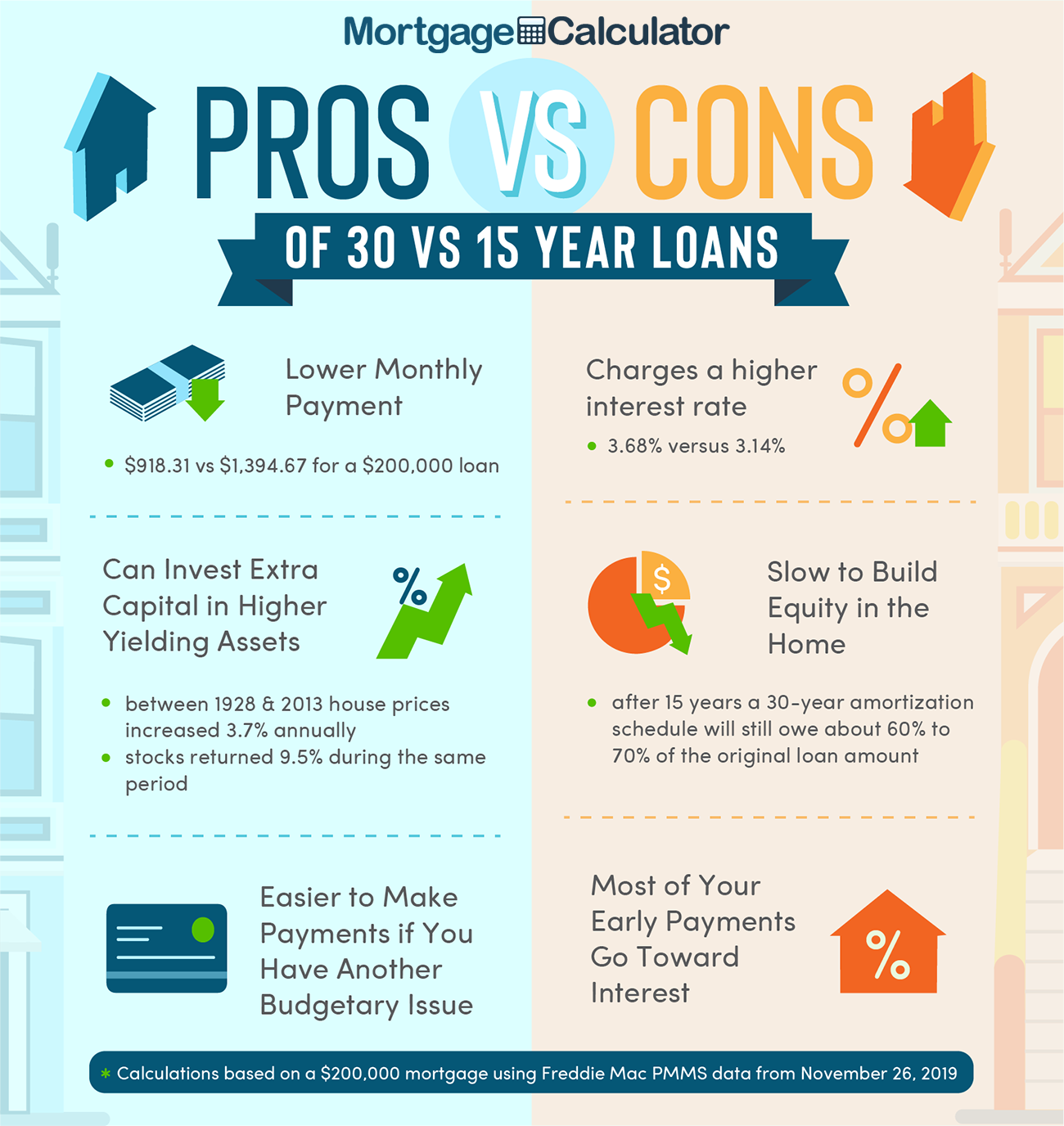

Which Mortgage Is Better 15 Vs 30 Year Home Loan Comparison Calculator

The Average Mortgage Length In The U S Rocket Mortgage

Td In 20 Seconds Amortization Period Vs Mortgage Term What Is A Mortgage Term The Mortgage Term Is The Length Of Time You Re Committed To Your Mortgage Interest Rate Lender And

Treasury Snapshot February 17 2023 Dshort Advisor Perspectives

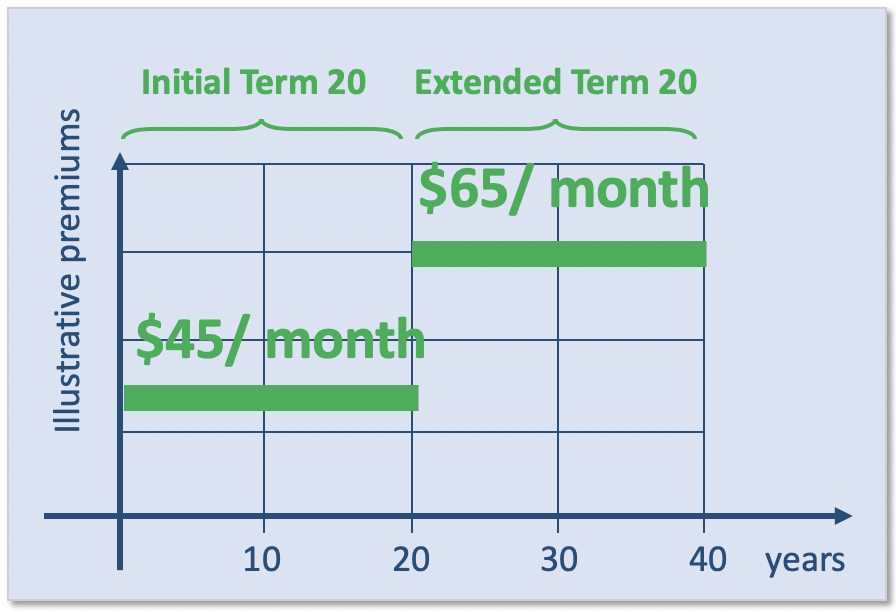

Term 20 Life Insurance Quotes Rates Expert Tips

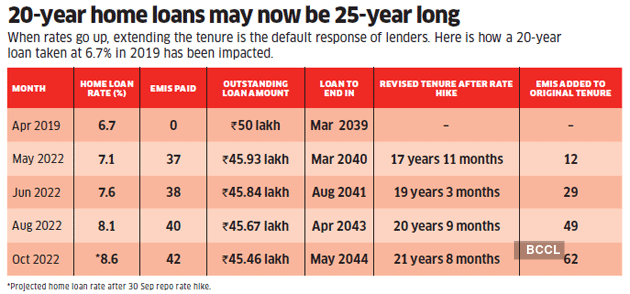

Rising Interest Rates Mean A 20 Year Home Loan Will Take 25 Years To Repay What Borrowers Can Do The Economic Times

Which Is A Better Decision Taking A Home Loan Or Buying It Once I Have The Money Quora

What Is A 20 Year Mortgage Rocket Mortgage

The Rate And Term Refinance Explained What It Is And How It Works

What Choose Loan Market

Pay Off Your Mortgage Or Invest This Calculator Will Help You Decide

:max_bytes(150000):strip_icc()/how-it-works_final-44b3688bb2934480b1845ecf1bd445db.png)

How Mortgage Interest Is Calculated