Wage calculator with overtime

So if your regular. The algorithm behind this overtime calculator is based on these formulas.

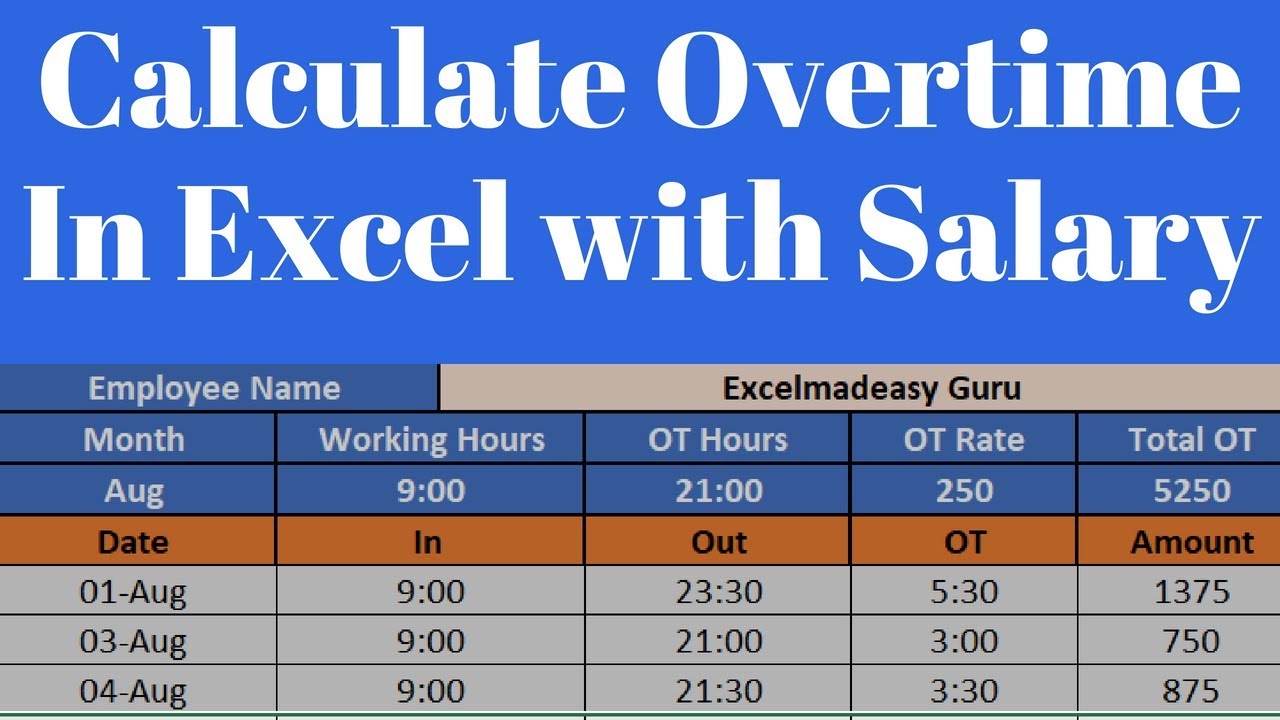

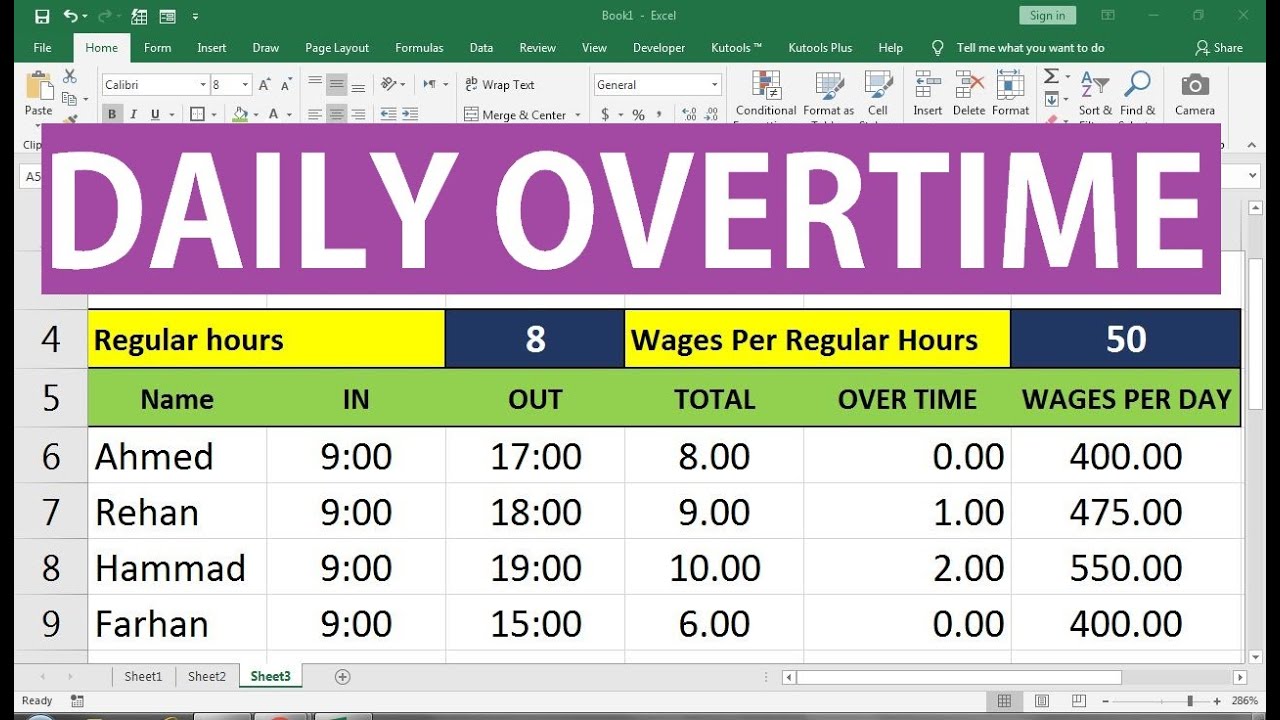

How To Calculate Overtime In Excel In Hindi Youtube

-Overtime gross pay No.

. Overtime pay of 15 5 hours 15 OT rate 11250. Total pay per week Basic pay Shift differential Overtime. Ad See the Wages Tools your competitors are already using - Start Now.

Overtime rates may vary depending on. How to calculate overtime pay. You calculate the total amount per week as follows.

Which means you have worked overtime for 8 hours. Ad Set pay with trusted wage survey data. We use the most recent and accurate information.

The additional three hours of retro pay not only need to be paid but paid at 15 times the regular pay rate as they are calculated as overtime in the prior pay period. 3 rows Regular pay of 15 8 hours 120. Calculate overtime pay for a monthly-rated employee Calculate overtime pay for a monthly-rated employee If you are a monthly-rated employee covered under Part IV of the Employment Act.

In a few easy steps you can create your own paystubs and have them sent to your email. This law includes nonexempt employees who are paid hourly salary and those who are paid on piece rate. Ad Accurate Payroll With Personalized Customer Service.

All Services Backed by Tax Guarantee. Calculate the approximate number of hours that an. All inclusive payroll processing services for small businesses.

18 regular pay rate x 15. Free demo for HR professionals. This calculator can determine overtime wages as well as calculate the total earnings.

Using a 30 hourly rate an average of eight hours worked each day and 260 working days a year 52 weeks multiplied by 5 working days a week the annual unadjusted salary can be. In a few easy steps you can create your own paystubs and have them sent to your email. Calculation of overtime is very easy and is.

Ad Compare This Years Top 5 Free Payroll Software. The federal overtime provisions are contained in the Fair Labor Standards Act FLSA. 35 hours x 12 10 hours x 15 570 base pay 570 45 total.

Used by HR to Set Competitive Pay. Ad Payroll So Easy You Can Set It Up Run It Yourself. C B PAPR.

Enter the number of paid weeks the employee works per year. We use the most recent and accurate information. An employer is required to pay their employees one and one-half times their regular.

For example if you make 20 an hour and worked 50. Overtime Number of overtime hours X Per hour salary X 25. Get a free quote today.

Your employer is required by federal law Fair Labor Standards Act to pay time and a half wages regular hourly rate x 15 for all hours worked beyond 40 hours per week. This calculator can determine overtime wages as well as calculate the total earnings for tipped employees. This employees total pay due including the overtime premium for the workweek can be calculated as follows.

Free Unbiased Reviews Top Picks. The table on this page shows the base pay rates for a GS-12 employee. The calculator works out the employee weekly pay and working hours and.

Get a free quote today. Of double hours Double rate per hour-Total gross pay Regular gross pay Overtime. This calculator can help with overtime rates that are 15 and 2 times the rate of the employees base pay.

To calculate an hourly employees overtime for a given week multiply the number of overtime hours worked by the overtime pay rate. B A OVWK. If you do any overtime enter the number of hours you do each month and the rate you get paid at - for example if you did 10 extra hours each month at time-and-a-half you would enter 10.

Read reviews on the premier Wages Tools in the industry. Unless exempt employees covered by the Act must receive overtime pay for hours. Ad Create professional looking paystubs.

Ad Create professional looking paystubs. However these rates are just a guide only. Overtime Security Advisor helps determine which employees are exempt from the FLSA minimum wage and overtime pay requirements under the Part 541 overtime regulations.

How to use the overtime calculator Input the employees annual salary. You can use this calculator to determine your pre-tax earnings at an hourly wage-earning job in Florida. To calculate pay with locality adjustments.

How To Use The Texas Wage Calculator Texas Overtime Wage Calculator. Basic Salary X 12365 per day salary. Of overtime hours Overtime rate per hour-Double time gross pay No.

Per day Salary8per hour salary. Below you can find a quick explanation of how our overtime calculator works. A RHPR OVTM.

Overtime pay per period. The hourly base pay of a Step 1 GS-12 employee is 3273 per hour 1. Overtime pay per year.

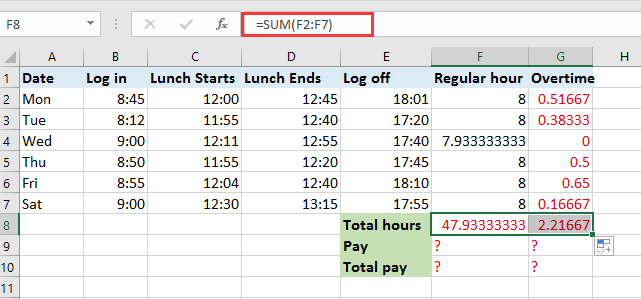

Calculate Overtime In Excel Google Sheets Automate Excel

How To Calculate Overtime Pay Easy Overtime Calculator A Basic Guide

Tom S Tutorials For Excel Calculating Salary Overtime Tom Urtis

How To Calculate Overtime Pay For Employees In Malaysia Althr Blog

Overtime Calculator

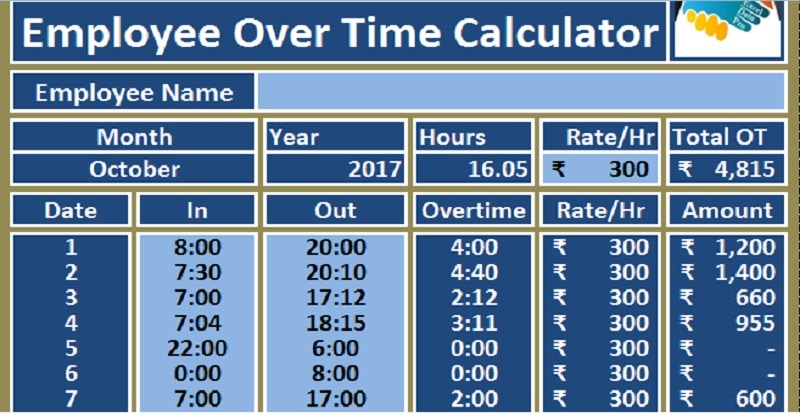

Download Employee Overtime Calculator Excel Template Exceldatapro

How To Calculate Overtime Pay For Hourly And Salaried Employees Article

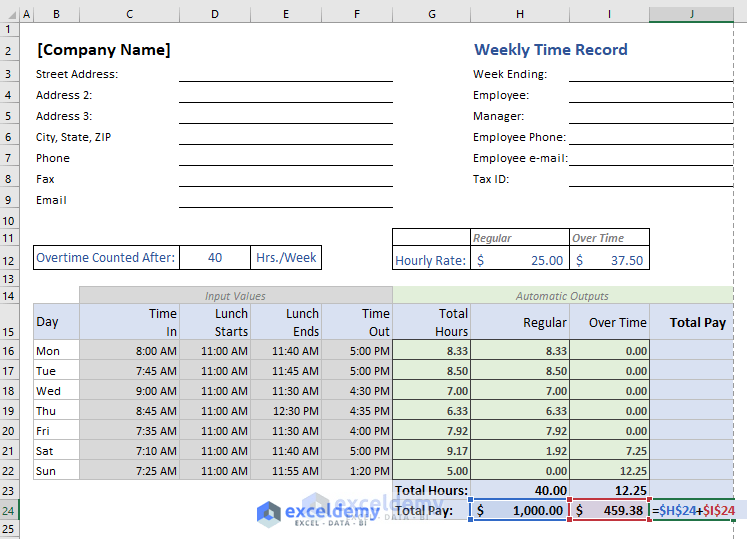

Excel Formula Timesheet Overtime Calculation Formula Exceljet

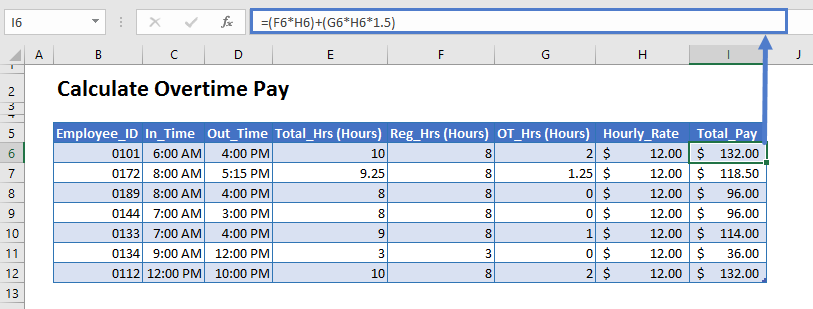

Excel Formula Basic Overtime Calculation Formula

Overtime Calculator Clicktime

Calculate Overtime In Excel Google Sheets Automate Excel

Overtime Pay Calculators

Excel Formula To Calculate Hours Worked Overtime With Template

How To Quickly Calculate The Overtime And Payment In Excel

How To Quickly Calculate The Overtime And Payment In Excel

Overtime Calculation Formula In Excel Youtube

Overtime Pay Calculators